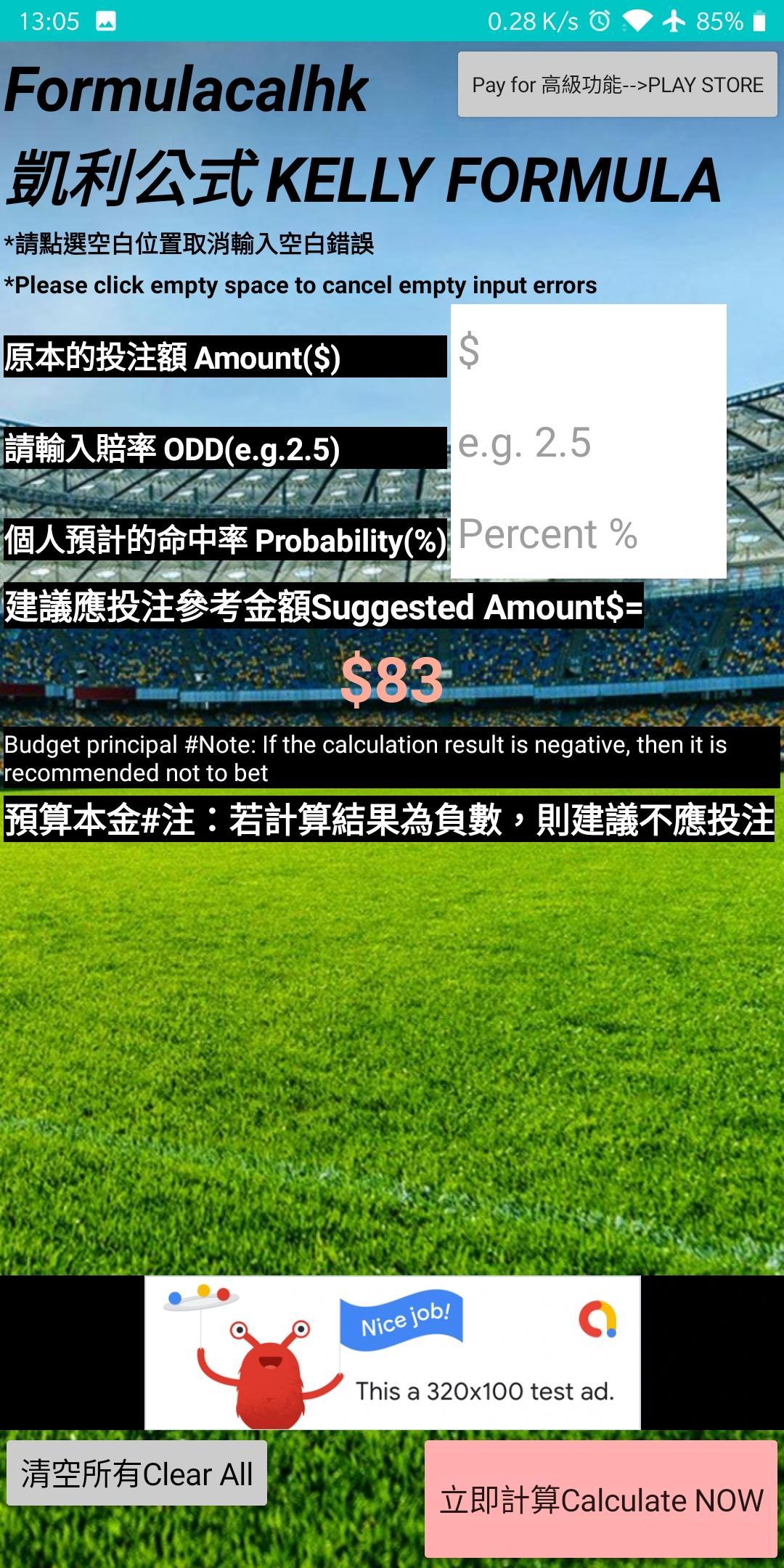

Kelly Formula

How to use the Kelly Criterion calculator for traders

The Kelly criterion is formula that calculates the proportion of your balance to wager on a particular gamble. Learn more about the Kelly criterion. Understanding the Kelly Criterion. Investors often face a tough decision when trying to decide how much money to allocate, as staking either too much or too little will result in a large impact either way. The Kelly criterion is a money-management formula that calculates the optimal amount to ensure the greatest chance of success.

The Kelly Criterion is a formula invented by J.L. Kelly Jr in 1956 that determines the optimal risk per tradefor a trading strategy or betting system with a positive edge.

1) Win rate: Enter the percentage of trades that your strategy wins

(For example, if you have a 40% win rate, then enter the number '40', not 0.40.)

2) Reward per Dollar Risked: Enter the amount of capital your strategy, on average, profits for everydollar risked per trade.

(For example: If you strictly following a 2-to-1 reward-to-risk ratio, then enter 2. Despite the advice ofso-called educational services, it's not mathematically necessary for this to be greater than one in order to beprofitable, but the proportion between this and win rate does need to be balanced so that expectancy is positive.The Kelly Criterion offers the side effect of recommending risking nothing at all, ie. not trading, if expectancyis negative.)

Using the Kelly Criterion with Your Portfolio. Extending Kelly a bit further (like Ed Thorp, author of two math bibles for the investor/bettor Beat the Dealer and Beat the Market, has done) we can do a bit of hand-waving and make it work for the stock market.Some derivations of 'Stock Market Kelly' involve using back-looking numbers such beta to approximate the continuous returns of securities.

3) Kelly Fraction: Choose the fraction of the Kelly percentage you want the calculator to output.

(* Using the full Kelly percentage is extremely risky in any real-world financial market as probabilitiesare not fixed - market conditions change. Every system or strategy needs room to show its edge is weakeningwithout wiping out all prior gains.)

In theory, if a system has (and will continue tomaintain) a positive expected value (mathematical expectancy), risking the full Kelly criterion percentage on each trade will maximize thereturn of the strategy. However, traders should always bear in mind that the market is not a static machine butan aggregate of a large number of individual humans (and/or human-designed automated systems) making interactingdecisions so conditions do change.

At best, most professional traders recommend using a fraction of the Kellycriterion at the very most.

Either way, both backtesting and past performance are great ways to measure the potential of a strategy or systembut also carry a very real limitation: some of the most profitable strategies of the past have, over time, lost theiredge due to market changes. Never become over-confident in any particular strategy. Always ensure that any money usedto trade is risk capital that you can afford to lose without affecting your standard of living.

Be sure to enable JavaScript on your browser for this calculator to work as intended.

Back to Forex Tools